How “Carbon Fee and Dividend” Serves Economic and Environmental Justice

Jonathan Marshall

June, 2021

Summary

Two foundational issues for many Americans are economic and environmental justice. During the 2020 presidential campaign, candidate Joseph Biden introduced his $2 trillion “Plan to Secure Environmental Justice and Equitable Opportunity in a Clean Energy Future.” That was an unusual but telling name for a climate plan, reflecting his commitment to fighting a broad range of social inequities. Climate policies must be judged first and foremost on their effectiveness in curbing runaway global warming. They are not solutions to all social ills. But climate mitigation policies cannot be politically credible if they aggravate existing inequities—for example, by raising the cost of energy (and energy-intensive goods and services) for low- and moderate-income households with no immediate offsetting benefit.

The good news is that “carbon fee and dividend” is not only “the most cost-effective lever to reduce carbon emissions at the scale and speed that is necessary,” according to an unprecedented number of economists; it will also do more than any other standalone climate policy to address pervasive economic and environmental inequities.

The Challenges of Economic and Environmental Injustice in the United States

Discussions of social equity sometimes conflate two related but distinct concepts: economic justice and environmental justice.

- Economic justice seeks to reduce income and wealth gaps to create more opportunities for disadvantaged groups. To this end, the costs of a climate solution should not fall on lower-income individuals and households.

- Environmental justice seeks to:

- end the unfair concentration of unhealthy air and water pollution in poor and minority communities, and

- implement effective policies to mitigate the great harm caused by climate disruption to disadvantaged communities

This paper will examine each issue briefly in turn, and then assess the comparative impacts of carbon fee and dividend policies and traditional regulatory/subsidy approaches to climate with respect to these two crucial aspects of social policy.

Economic Justice

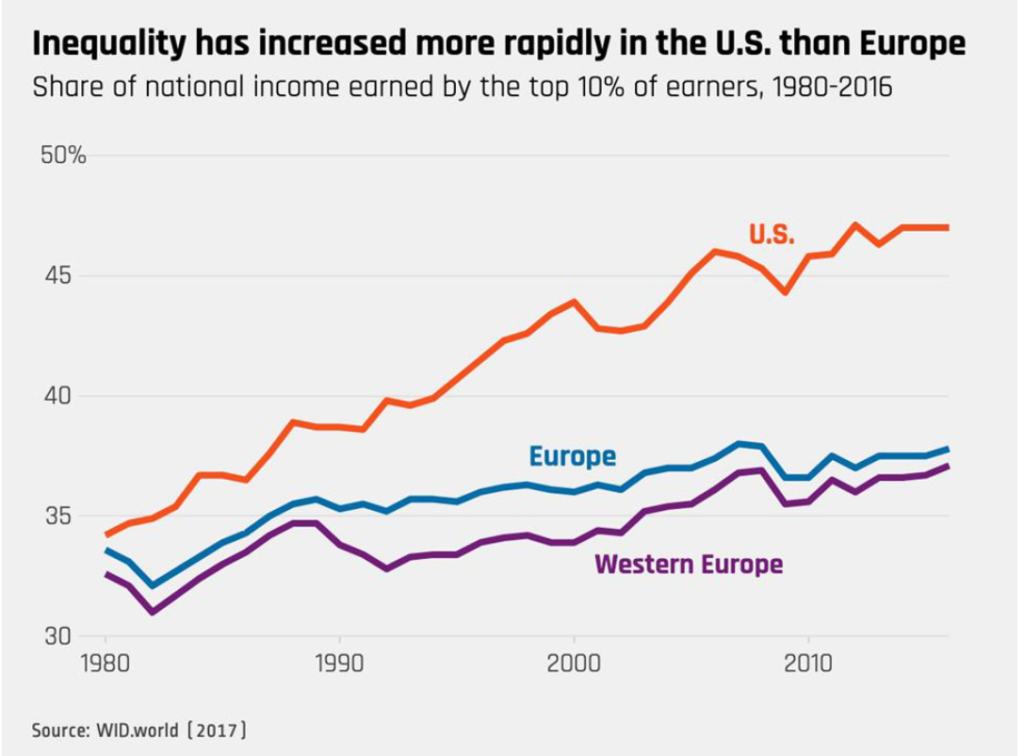

The growth of income inequality in the United States is virtually without parallel in the developed world. Today the top tenth of Americans earn nearly half of all national income.

Source: https://equitablegrowth.org/eight-graphs-that-tell-the-story-of-u-s-economic-inequality/

Rising inequality and wage stagnation have aggravated the scourge of poverty in America, which is closely linked to race and ethnic background. More than three times as many African Americans live in poverty than white Americans. A devastating United Nations report noted in 2018 that America’s “immense wealth and expertise stand in shocking contrast with the conditions in which vast numbers of its citizens live. About 40 million live in poverty, 18.5 million in extreme poverty, and 5.3 million live in Third World conditions of absolute poverty.”

Such extreme economic inequities are not merely shameful, they are matters of life and death. Deaths from such factors rival those from major diseases. A study published in the American Journal of Public Health on the causes of deaths in 2000 estimated that 245,000 deaths were linked to low education, 133,000 to individual poverty, and 119,000 to income inequality.

Environmental Justice

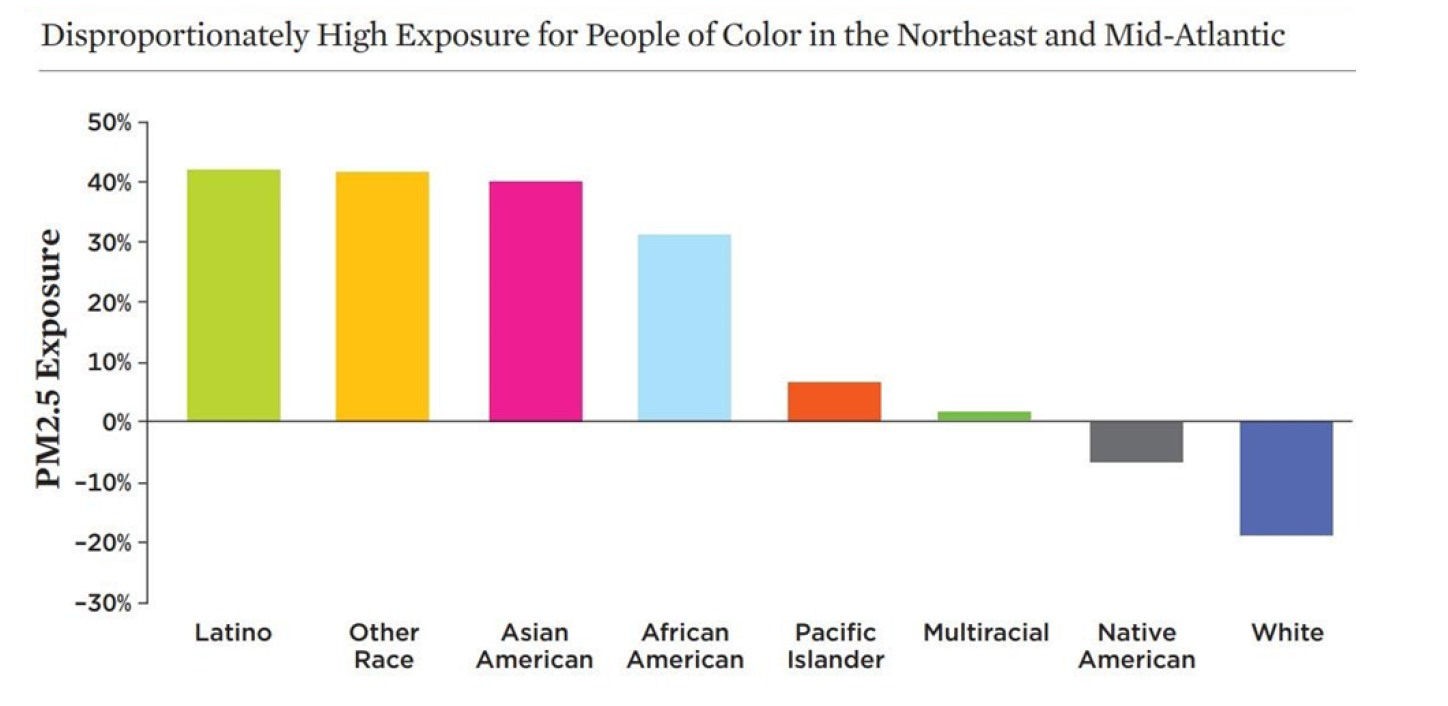

Environmental pollution and harm are distributed as unequally as income in America. Numerous studies confirm, for example, that deadly fine particulates plague communities of color much more than their white counterparts. The EPA also reports that poor Americans are exposed to 1.4 times higher levels of particulates than average.

Source: https://www.ucsusa.org/resources/inequitable-exposure-air-pollution-vehicles

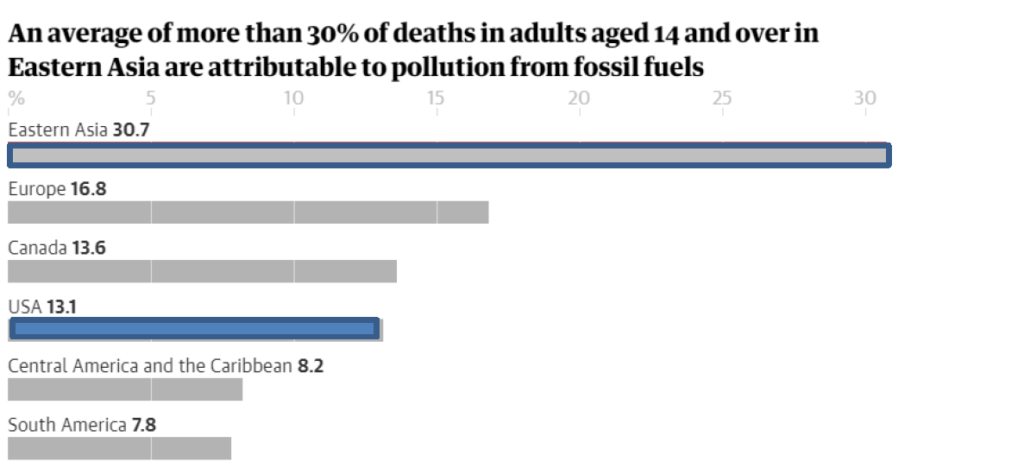

Like economic inequality, fossil fuel pollution isn’t merely unpleasant, it kills. Air pollution causes nearly 250,000 premature deaths per year in the United States, according to Duke University researchers. Fine particulates released by burning fossil fuels account for 13% of deaths in the United States among people aged 14 and over.

Source: www.theguardian.com/environment/2021/feb/09/fossil-fuels-pollution-deaths-research

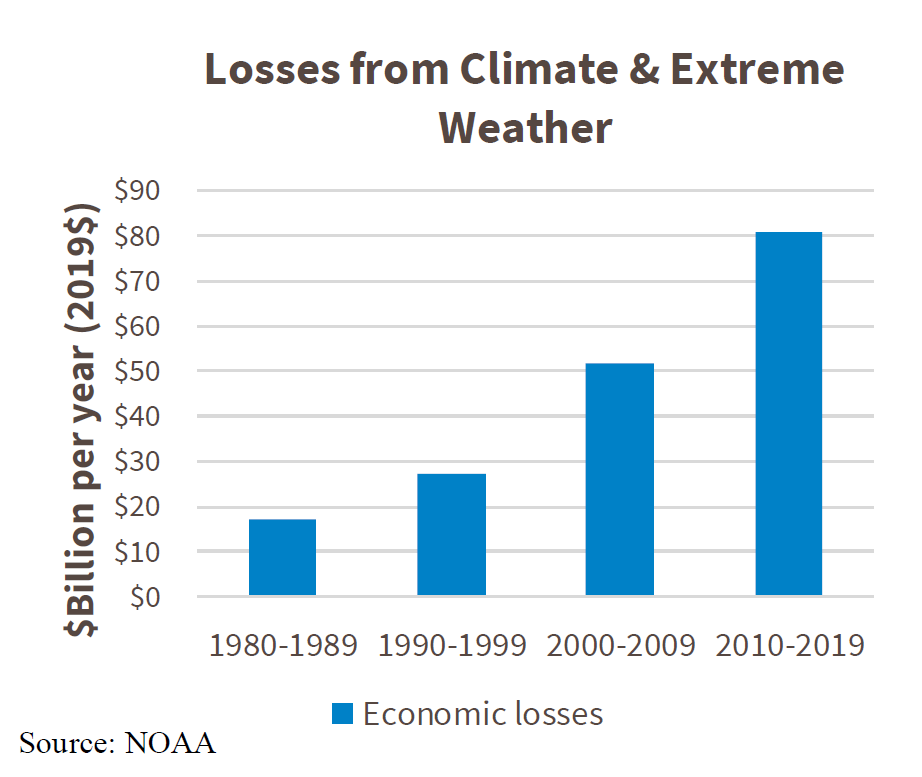

Those same fossil fuels, of course, disrupt the climate with their emissions of greenhouse gases. The number and costs of major climate disasters are soaring at a staggering rate.

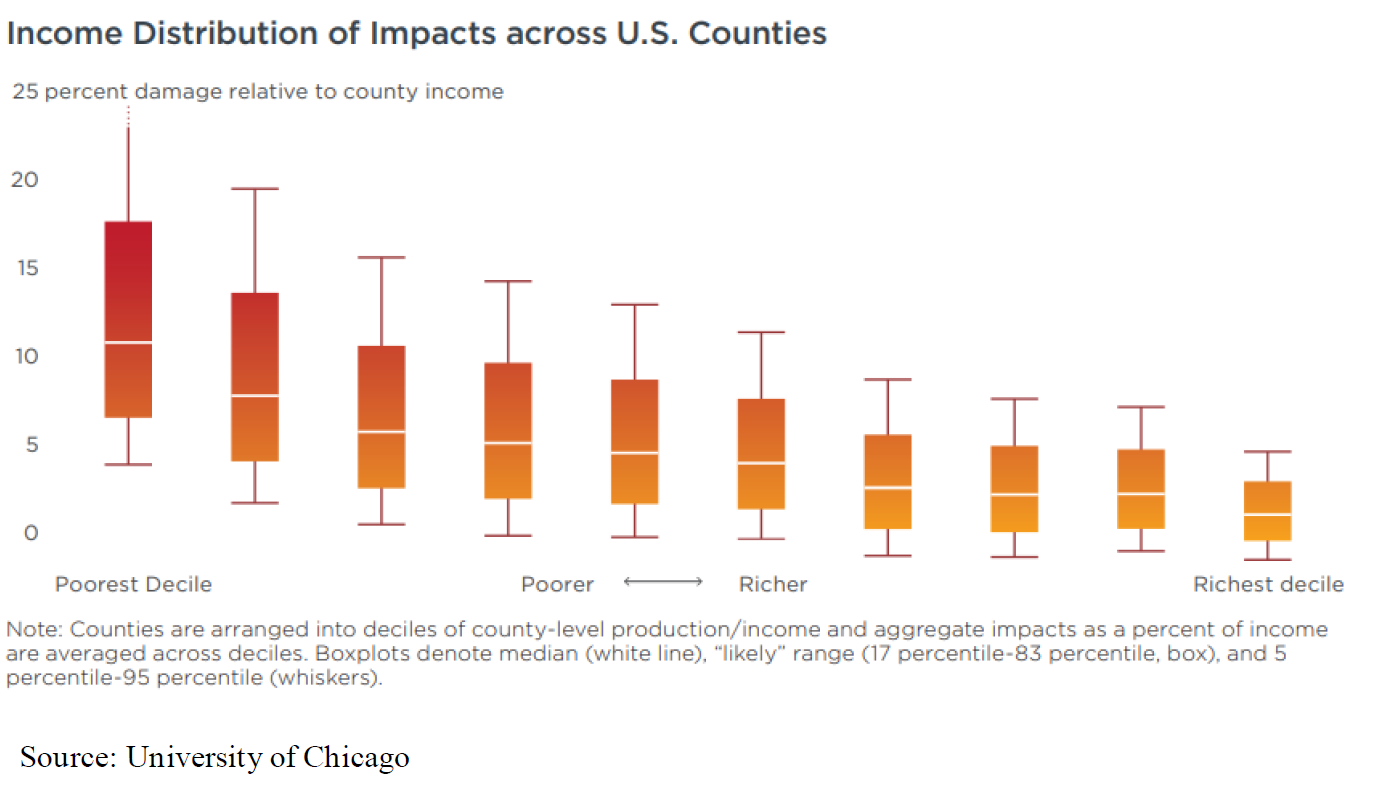

The costs of floods, severe heat, and wildfires tend to fall hardest on the poor (including poorer countries), who cannot afford insurance or adaptive measures to protect their homes and lives. The chart below shows that poor counties will suffer the most from climate damage in 2080 if little is done to address the problem. According to a University of Chicago study, “the poorest third of counties are projected to experience damages of between 2 and 20 percent of county income under a high emissions scenario. This aspect of climate impacts in the United States has the potential to substantially widen the income gap between rich and poor parts of the country, saddling those areas that may already have fewer resources to adapt with larger damages.”

The costs of floods, severe heat, and wildfires tend to fall hardest on the poor (including poorer countries), who cannot afford insurance or adaptive measures to protect their homes and lives. The chart below shows that poor counties will suffer the most from climate damage in 2080 if little is done to address the problem. According to a University of Chicago study, “the poorest third of counties are projected to experience damages of between 2 and 20 percent of county income under a high emissions scenario. This aspect of climate impacts in the United States has the potential to substantially widen the income gap between rich and poor parts of the country, saddling those areas that may already have fewer resources to adapt with larger damages.”

The important lesson is that few measures will do more to serve environmental justice than speedy and effective action to curb climate change.

Carbon Fee and Dividend: The Fastest, Most Cost-Effective Lever

To that end, an unprecedented 3,600 economists, including 27 Nobel laureates, have declared that a steadily rising tax or fee on fossil fuels is “the most cost-effective lever to reduce carbon emissions at the scale and speed that is necessary.” They also support returning the revenue to individuals in the form of regular equal payments, more than making up for costs faced by most low- and moderate-income Americans while avoiding the need for complicated “means tests.” The policy they overwhelmingly endorse is known as “carbon fee and dividend.”

Experts from many other disciplines, including such notable climate scientists as Dr. James Hansen, agree that such market incentives can be a decisive means of encouraging consumers and producers throughout the economy to quickly seek cleaner alternatives. The Lancet Commission on Health and Climate Change, representing some of the world’s leading public health authorities, reported in 2015: “The single most powerful strategic instrument to inoculate human health against the risks of climate change would be for governments to introduce strong and sustained carbon pricing, in ways pledged to strengthen over time until the problem is brought under control. Like tobacco taxation, it would send powerful signals throughout the system, to producers and users, that the time has come to wean our economies off fossil fuels, starting with the most carbon intensive and damaging like coal.”

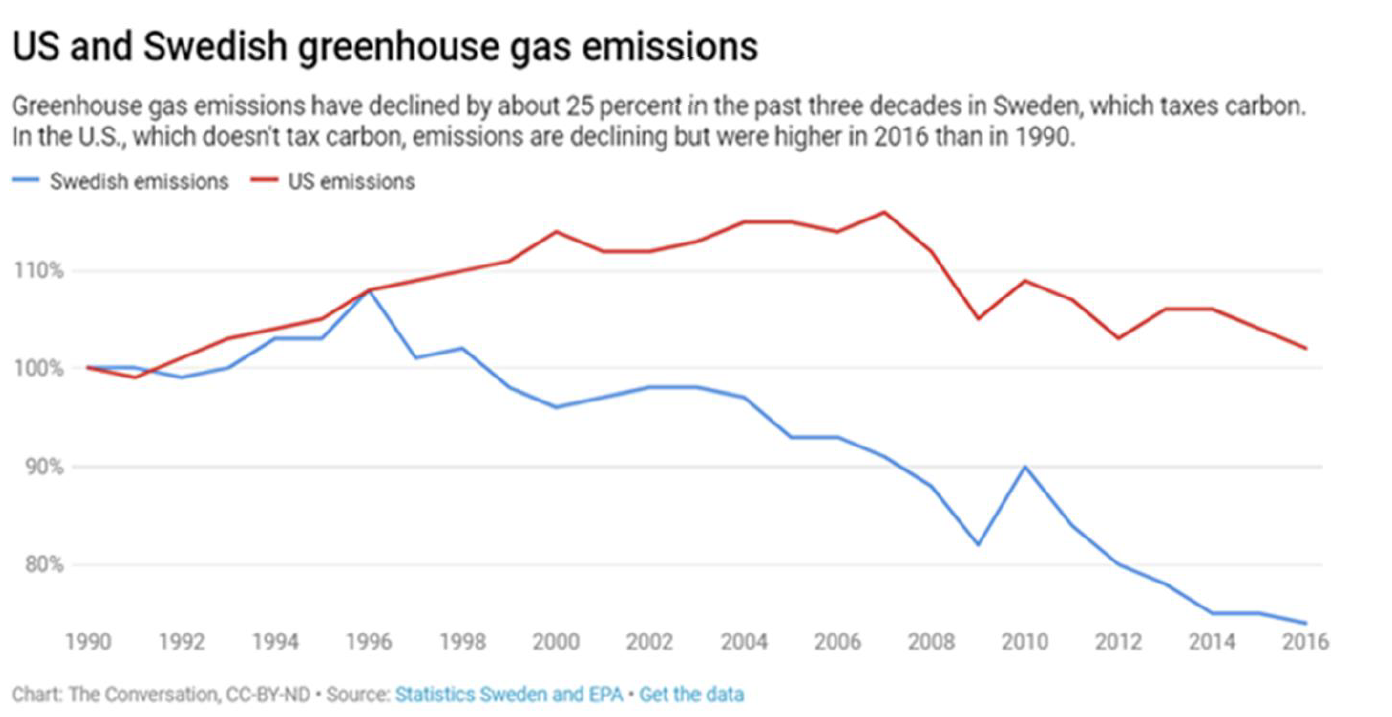

Economists at Resources for the Future analyzed the carbon-fee-and-dividend policy prescribed in the Energy Innovation and Carbon Dividend Act (H.R. 763 and H.R. 2307), which sets a starting price of $15 per ton of carbon dioxide, increasing $10 a ton annually. They determined that such a policy would reduce emissions more than 50 percent by 2030 relative to 2005, and even more in later years. Their finding is consistent with many other models of the United States, and with studies of other rich countries that use price incentives to discourage CO2 pollution in major sectors of their economies. In great part as a result of its carbon and fuel taxes, Sweden today emits only a third as much carbon dioxide per dollar of GDP as the United States, without any slowdown in economic growth. In the UK, a modest price on carbon virtually eliminated the widespread use of dirty coal-fired power in the electricity sector.

Environmental and Health Benefits of Carbon Fee and Dividend

Besides slowing the destructive effects of climate change, the use of carbon fees to curb the burning of fossil fuels would slash harmful local air pollution. A Columbia University study of rising carbon fees finds that in the electric power sector, “sulfur dioxide and mercury emissions would be reduced by over 95 percent and emissions of nitrogen oxides would be reduced by about 75 percent in 2030 compared to current policy.” Mercury is a potent neurotoxin, and the other two emissions attack human lungs and increase rates of premature death.

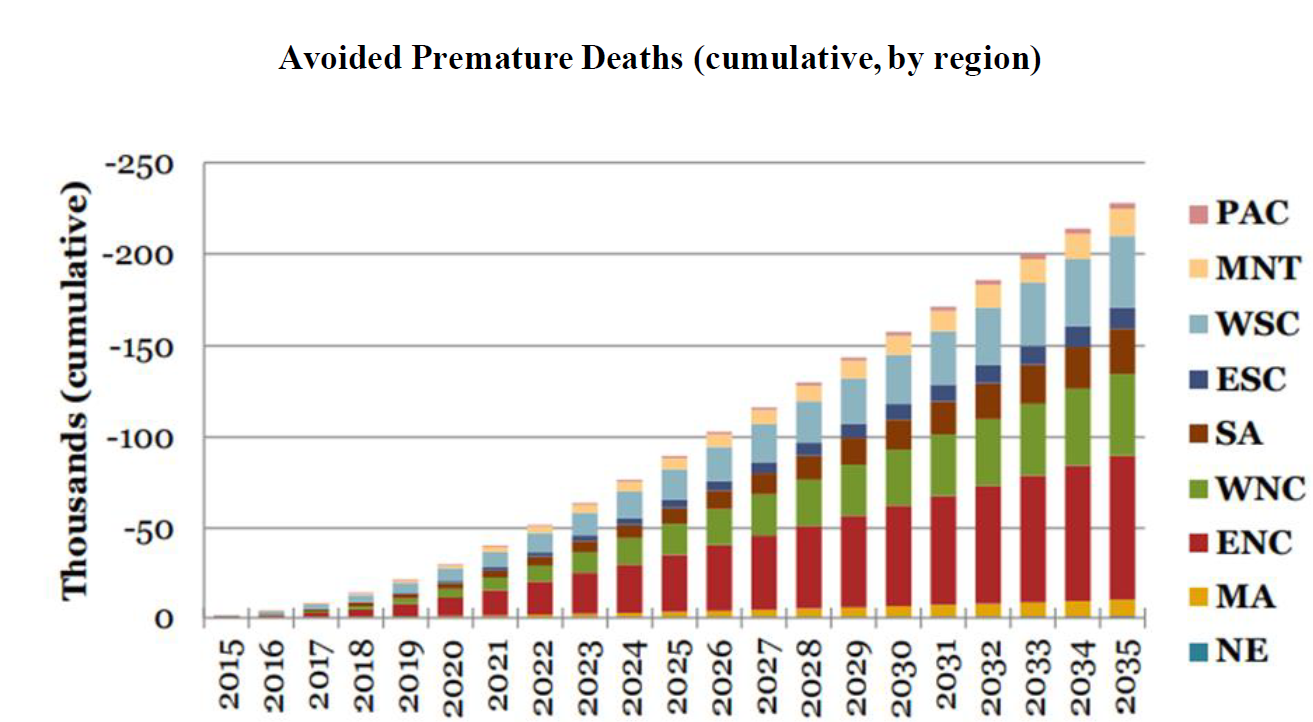

A 2014 study estimated that over the course of 20 years, a rising carbon fee would save nearly a quarter million lives due to reduced air pollution from burning fossil fuels (chart below). Many of those health benefits, as we have seen, would accrue to disadvantaged communities. Newer estimates from Duke University suggest that reductions in air pollution and extreme heat from a strong carbon fee policy would save an estimated 4.5 million premature deaths and 3.5 million hospital visits in the United States over 50 years.

Source: Regional Economic Models, Inc. and Synapse Energy Economics, Inc., June 2014

All of these benefits—slowing the disruptive effects of climate on disadvantaged communities and slashing deadly air pollution—would be huge victories for environmental justice and humanity generally.

Note: Some environmental justice advocates warn that certain carbon pricing schemes allow pollution hot spots to remain in disadvantaged communities, citing disputed evidence from California. The state’s “cap and trade” program to price carbon allows local industries to keep polluting their communities if they invest in other forms of carbon reduction (“offsets”), like forest preservation, somewhere entirely different. However, carbon fees typically apply to every polluter equally, without local offsets. That’s why in 2017, California’s Environmental Justice Advisory Committee urged the state to replace its cap-and-trade system with a “system like a carbon tax or fee and dividend program.”

How Dividends Promote Economic Justice

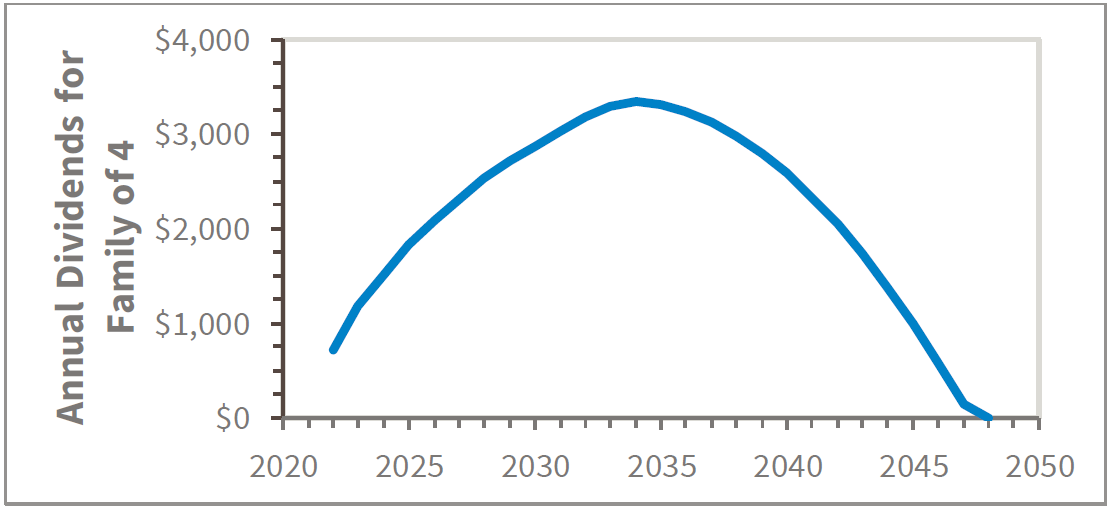

While a steadily rising fee on fossil fuel pollution helps deliver swift and meaningful environmental justice, the dividend delivers a remarkable measure of economic justice. Checks from the Treasury Department totaling a few thousand dollars a year will turn a potentially costly transition away from fossil fuels into an economic benefit for most families. (Some revenue could also be temporarily earmarked to support distressed communities, e.g., in coal country.)

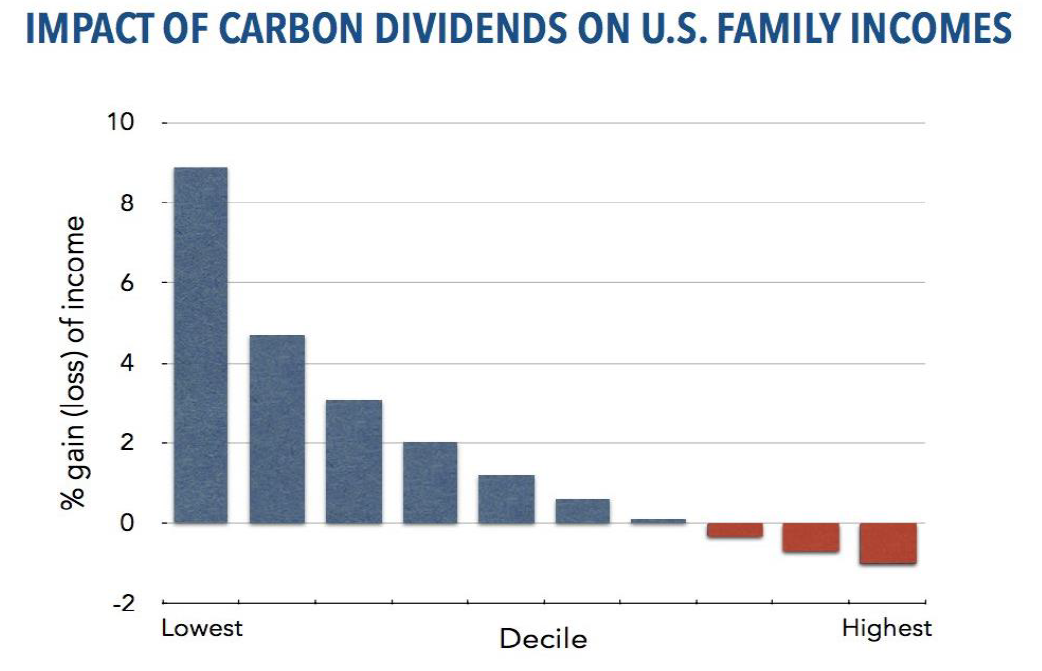

Source: https://community.citizensclimate.org/resources/item/19/393

Such dividends will also mean much more to a poor household than to a rich one, even without means tests, as shown below by the results from a 2017 Treasury Department study. The bottom tenth of households would see income gains of more than eight percent. These figures are net of costs—they account for the fact that a carbon tax would raise the cost to households of electricity, gasoline, and heating with fossil fuels, as well as products that rely on fossil energy for their manufacture or transportation. Since more than half of households stand to come out ahead, a universal dividend can help build strong political support behind a carbon fee, just as Social Security today is one of the most cherished of all federal programs.

Climate Regulations Should Complement, Not Replace, Carbon Fee and Dividend

Carbon fee and dividend isn’t the cure for all social justice issues, of course. It’s not even a complete cure for the climate crisis. Certain regulations and subsidies are needed to complement carbon fees, reducing greenhouse gas emissions that market incentives can’t reach. Examples include regulations to control fugitive emissions of methane from oil wells and pipelines, incentives to encourage climate-friendly farm practices, and R&D subsidies to promote new technology breakthroughs.

But any attempt to substitute regulations and subsidies for carbon fees would be a costly mistake. To take just one example, researchers from MIT report that tougher fuel efficiency standards for new vehicles would cost the economy — for the same reduction in gasoline use — at least six times more than a carbon tax of $45/ton. That’s because a carbon tax provides immediate, direct incentives for drivers to reduce gasoline use by driving fewer miles or taking transit, while efficiency standards must squeeze the reduction out of new vehicles only. Also, unlike fuel standards, a higher tax on fuels gives people an incentive to buy more efficient new or used vehicles rather than holding onto their gas-guzzlers. Studies also show that vehicle fuel efficiency standards are more regressive than a carbon fee and dividend. That is, they fall harder on lower-income households by raising the cost of new cars and, inevitably, of used cars.

Finally, regulations raise costs but don’t generate revenues to help lower-income families finance their transition to a low-carbon economy. Bottom line, regulations are generally far less effective than carbon fee and dividend at serving the causes of either economic or environmental justice.

Subsidies can be problematic, too. Subsidies that simply lower the cost of clean energy, for example, have the unintended consequence of discouraging the cleanest solution of all, energy conservation. That can work against the cause of environmental justice. Carbon fees, on the other hand, give everyone an incentive to use energy more efficiently.

Subsidies often run counter to the cause of economic justice as well. A 2016 study of $18 billion in federal income tax credits for weatherizing homes, installing solar panels, buying hybrid and electric vehicles, and other “clean energy” investments from 2006 to 2013 found the great majority of benefits went to upper-income households, not the poor. The most extreme example was electric vehicles tax credits, where the top income fifth received about 90% of all credits. California rooftop solar subsidies have the perverse impact of raising statewide electric rates, harming the poor and discouraging electrification of vehicles and HVAC systems.

Promises of Justice are Not Enough

Climate activists need not shoulder the entire burden of achieving economic and environmental justice. Their mission is ambitious enough as it is. At the very least, however, any serious climate proposal must document its impacts on historically disadvantaged communities and do no harm.

Numerous economic modeling studies show that carbon fee and dividend would not only have an immediate and decisive impact on curbing greenhouse gas emissions but would also slash other harmful air pollutants that plague many communities today. No less important, the dividend would provide a dependable financial benefit to lower-income families for many years, more than cushioning them against the blow of rising energy costs at home and for transportation. Advocates of alternative policies based on regulations and subsidies must prove how their solutions will more quickly and cost-effectively contain the climate crisis, and clean up other pollution, without imposing any undue burden on those least able to pay.

* Jonathan Marshall is a co-founder of Citizens’ Climate Lobby’s Economic Policy Network and former Economics Editor of the San Francisco Chronicle.