Senate Environment and Public Works Committee

Jonathan Marshall, March 31, 2022

Written Statement by Citizens’ Climate Lobby Senate Environment and Public Works Committee

“Promoting American Energy Security by Facilitating Investments and Innovation in Climate Solutions”

March 31, 2022

Citizens’ Climate Lobby

1750 K St. NW Suite 1100

Washington, D.C. 20006

Citizens’ Climate Lobby (CCL) appreciates the opportunity to submit written testimony to the Senate Environment and Public Works Committee following its March 23, 2022 hearing on Promoting American Energy Security by Facilitating Investments and Innovation in Climate Solutions.

CCL is a grassroots organization that trains and supports volunteers to build relationships with their elected representatives in order to influence climate policy. CCL works to create political will for climate solutions while empowering individuals to exercise their personal and political power. CCL has approximately 200,000 supporters nationwide from every state and congressional district.

Introduction

Crude oil and gasoline prices in the United States have soared since the lows reached during the pandemic-caused recession in 2020. The global economic recovery ignited the price rebound while supply chain disruptions have restricted growth in output of these energy sources. Now, adding misery to many industries and consumers, the Russian invasion of Ukraine and ensuing economic sanctions have further roiled global oil and gas markets. Although domestic prices of oil and gasoline, adjusted for inflation, are not at record levels, they remain uncomfortably high and even more volatile than usual.(1) For millions of Americans with modest incomes, this hit to their pocketbooks is painful at a time when food and housing prices are soaring as well.

As usual, during supply shocks influenced by geopolitical crises such as wars or embargoes, Americans have become painfully aware that our nation’s unaddressed addiction to fossil fuels puts our “energy security” and well-being at risk. And just as usual, pundits offer very different solutions. This testimony will present evidence that, for the sake of America’s energy security among other reasons, strong federal policy is urgently needed to accelerate our transition away from fossil fuels toward efficient use of renewable and other alternative energy sources. The single most effective policy, advocated by legions of economists, energy experts, and climate scientists, would be a steadily rising fee on the carbon content of climate-polluting fossil fuels. Such a predictable fee would send a strong signal to every participant in the economy to adopt low-carbon domestic energy alternatives that would minimize recurrences of our current pain and enhance our quality of life. It would also raise revenues that could be used to help households and communities manage the costs of this essential economic transition.

Two roads diverge

In the midst of the latest of many oil crises, calls have predictably gone out to stimulate more U.S. fossil fuel production and even to suspend gasoline taxes that pay for the roads we drive on.(2) Neither of these proposals change the fundamental fact that highly volatile oil and gas prices are set by global markets, and have soared recently not just here but in many countries.(3) Greater U.S. production—which is already higher than at any time prior to 2018—would have only a small impact on world prices. Issuing new drilling permits on federal land in particular will not relieve the immediate pain, given the long lead time to begin producing and delivering oil. (Additionally, more than 9,000 approved permits on federal and Indian lands were unused at the end of 2021.(4)) Market forces already provide incentives for the oil industry at home and abroad to increase production in response to high prices without special intervention. But as the International Energy Agency notes in a recent report, “New oil production projects could increase liquidity in the market in the medium term but would not be able to ease the current strains.”(5)

Like many independent experts, the IEA recommends instead a series of practical measures to ease prices by reducing oil demand. Contrary to its logic, calls to suspend gasoline taxes that pay for crucial infrastructure would raise demand. Some legislators in California wisely propose instead making temporary direct payments to households to ease their financial burden. The IEA endorses such payments as “a means to target the poorest parts of the population.”(6)

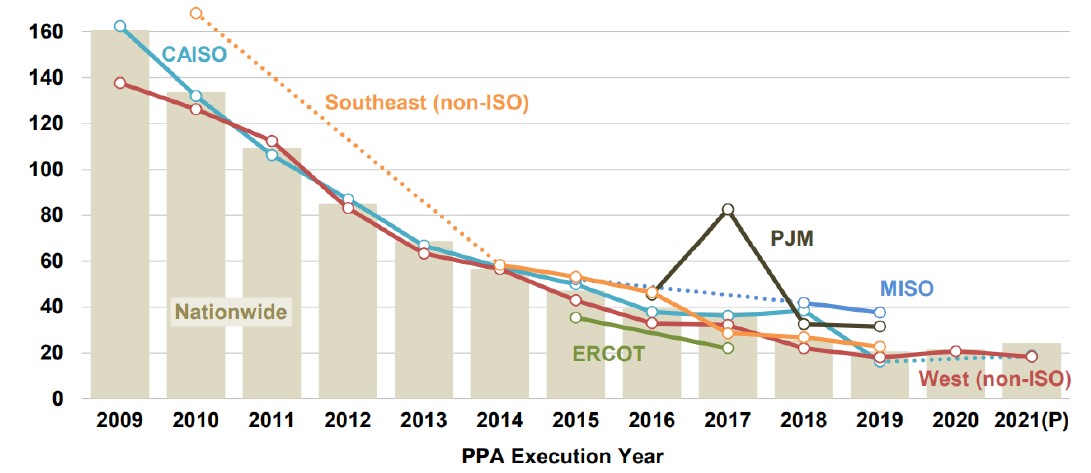

In the longer run, the IEA advocates policies to slash oil demand “in line with the need to cut global oil use to reach net zero emissions by 2050.” Such policies include prioritizing support for electric vehicles, raising fuel economy standards, and accelerating the replacement of oil boilers with efficient heat pumps. With strong encouragement from President Biden, European planners are moving quickly to promote energy efficiency and production of renewable wind and solar energy.(7) That approach makes sense in the United States as well. Not only is domestic renewable energy more secure than imported oil and gas, it is subject to much less disruptive price volatility. Compare the price trends of U.S. gasoline futures to solar energy power purchase agreements (PPAs):(8)

Gasoline Futures ($/gallon

Average Levelized Solar PPA Price (2020 $/MWh)

An obvious (though difficult) choice

The prudent choice between these two divergent energy paths—doubling down on fossil fuels or accelerating the transition to clean energy—has become all too obvious in the wake of the latest dire report from the Intergovernmental Panel on Climate Change. The report highlights the “severe risks” both to humanity and the biosphere from exceeding overall warming of 1.5°C in coming decades by burning more fossil fuels.(9) These risks include crossing tipping points that could irreversibly disrupt the global climate system.

United Nations Secretary General António Guterres warned, “The 1.5-degree goal is on life support . . . We are sleepwalking to climate catastrophe. If we continue with more of the same, we can kiss 1.5 goodbye. Even 2 degrees may be out of reach. And that would be catastrophe.” He insisted that focusing on finding alternative sources of fossil fuels to replace those lost by Russia would only raise the odds of disaster. “This is madness,” he said. “Addiction to fossil fuels is mutually assured destruction.” Consistent with those statements, a recent UK study concluded that meeting the 1.5°C target will require “immediate and deep cuts in the production of all fossil fuels.”(10)

Russia’s invasion of Ukraine has also made the choice more obvious for many people. Ukrainian climate scientist Svitlana Krakovska, a member of the IPCC, said,

I started to think about the parallels between climate change and this war and it’s clear that the roots of both these threats to humanity are found in fossil fuels. Burning oil, gas and coal is causing warming and impacts we need to adapt to. And Russia sells these resources and uses the money to buy weapons. Other countries are dependent upon these fossil fuels, they don’t make themselves free of them. This is a fossil fuel war. It’s clear we cannot continue to live this way; it will destroy our civilization.(11)

The climate risks to energy security

Climate disruption threatens virtually every aspect of human security—including energy security, according to a 2021 assessment of climate challenges to U.S. national security by the National Intelligence Council. Among other findings, it assigned a “high” risk by 2040 of the “strain on energy and food systems” caused by climate change “impacting country-level instability.” It added in that regard, “Despite geographic and financial resource advantages, the United States and partners face costly challenges that will become more difficult to manage without concerted effort to reduce emissions and cap warming.”(12)

In the spirit of that finding, anyone who seriously proposes to reduce Americans’ energy insecurity—the focus of this hearing—must address one of the primary sources of that insecurity: the disruption and destruction of our energy infrastructure indirectly caused by the carbon-intensity of that very energy system. The Fourth National Climate Assessment in 2018 devoted an entire chapter to such risks. Citing the impacts of rising sea levels, extreme precipitation, droughts, extreme temperature swings, and other climate-induced threats, America’s top climate scientists reported:

The Nation’s energy system is already affected by extreme weather events, and due to climate change, it is projected to be increasingly threatened by more frequent and longer-lasting power outages affecting critical energy infrastructure and creating fuel availability and demand imbalances. The reliability, security, and resilience of the energy system underpin virtually every sector of the U.S. economy. Cascading impacts on other critical sectors could affect economic and national security.(13)

Similarly, Neil Chatterjee, former chair of the Federal Energy Regulatory Commission, wrote in a recent report,

Extreme weather events are increasing in frequency and duration, placing unprecedented strains on the U.S. electric power grid. When the grid fails, the human and economic toll can be staggering, amplifying the already-catastrophic costs associated with climate change. At the same time, extreme weather events have heightened the urgency to rapidly decarbonize the U.S. and global economy—including the power sector—to address climate risks.(14)

A few examples may help illustrate the magnitude of the risks to U.S. energy infrastructure from existing and future warming to the globe:

- In 2005, Hurricane Katrina shut down most oil and natural gas production in the Gulf of Mexico, the source of about a quarter of U.S. oil production and a fifth of its natural gas production. A month later, Hurricane Rita struck, closing a third of U.S. refining capacity and causing prices to soar for several months.(15) Hurricanes Gustav, Ike, and Harvey, among others, further disrupted oil and gas supplies in subsequent years.(16) In 2021, after major teams of scientists confirmed that warming was increasing the probability and severity of “extreme precipitation events” along the Gulf Coast, Hurricane Ida slammed into Louisiana. It shut down virtually all crude oil and natural gas production in federally administered areas of the Gulf. The immensely powerful storm, with 150-mile-per-hour winds, also took out extensive portions of the region’s electricity grid, slowing restoration of all services.(17)

- A 2012 study cataloged 130 natural gas, 96 electric generation, and 56 oil and gas facilities located near coasts less than four feet above the high-tide line, subject to being knocked out of commission by storms and flooding as sea levels rise.(18)

- Pipelines are also at risk from climate change. A report from the Organization for Security and Cooperation in Europe observes, “The Trans-Alaska pipeline alone carries as much as 20 percent of the US domestic oil supply. As temperatures rise, the permafrost melts. The ice trapped inside the frozen ground liquefies. If there is poor drainage, the water sits on the earth’s surface and floods. If there is good drainage, the water runs off, potentially causing erosion and landslides.”(19)

- Wildfires, aggravated by extreme heat and drought, pose great risks to energy infrastructure. In addition to causing many costly customer outages, historic wildfires in Northern California triggered by electrical discharges forced the nation’s largest combined gas and electric utility, Pacific Gas and Electric Co., into bankruptcy in 2019. Its proposal to reduce wildfire risk by burying thousands of miles of power lines in the state, if implemented, will cost customerstens of billions of dollars. That enormous sum represents the immense cost of adapting to clear and present levels of warming.(20)

- Droughts are already reducing hydropower production in the Western United States. Droughts and warming will also wreak havoc with thermal power plants, most of which are water-cooled. A 2016 report by the National Renewable Energy Laboratory cited “more than three dozen incidents where thermal power plants have been forced to curtail generation or shut down due to water-related temperature and availability issues” over the past decade. It warned that “These climate-induced changes could affect electricity demand as well as the performance and capabilities of generators to meet load, as increases in temperatures are likely to occur during the hottest part of the day when load is already at its highest.”(21)

For additional perspective on the extreme potential costs of climate disruption to energy infrastructure (and human life), consider the February 2021 electric grid blackout in Texas. This notorious disaster resulted in dozens of deaths, left more than 4.5 million homes without power, and caused nearly $200 billion in property damage, according to a comprehensive report by the University of Texas Energy Institute(22) The damage resulted from extremely cold winter storms caused by a disruption of the polar vortex. A 2021 paper in the prestigious journal Science pointed to climate change as a potential cause of this vortex disruption.(23)

Although some state leaders were quick to blame renewable energy for the supply disruption, serious experts quickly dismissed that scapegoating effort. Some wind turbines did freeze, cutting wind power capacity about 46 percent; solar generation, a much smaller supplier, actually fared better than expected. However, 84 percent of the supply shortfall was caused by shut-downs of gas- and coal-fired power plants due to fuel unavailability (freezing of gas wells and pipelines) and power plant malfunctions. Prudently winterizing gas fields and power plants to minimize future damage related to weather extremes will cost billions of dollars.(24)

What it will take to decarbonize America’s economy

The United States can ill afford more stranded fossil fuel investments, or worse yet, locking itself into further expansion of climate-disrupting energy. Such a course would only aggravate both climate and financial shocks to our country. That specter prompted the U.S. Treasury-led Financial Stability Oversight Council to warn last year that “Climate change is an emerging threat to the financial stability of the United States.”(25)

To limit warming to 1.5–2oC and avoid the worst climate scenarios, energy planners and far-sighted leaders are focusing on reaching net-zero carbon emissions by 2050. Achieving that extremely ambitious goal will require immediate policy shifts and trillions of dollars of new private and public investment. In the words of the International Energy Agency, which produced a roadmap to that end, “This calls for nothing less than a complete transformation of how we produce, transport and consume energy. . . It requires immediate and massive deployment of all available clean and efficient technologies” as well as “widespread use of technologies that are not on the market yet.”(26)

Such a transformation, which 69 percent of Americans embraced in a recent national poll,27 will require all hands on deck. It will take much more than government spending on new infrastructure or fine tuning of industry regulations. It demands nothing less than a broad, systemic redirection of the entire economy, enlisting private resources and innovation in every sector.

One policy effective and efficient enough to drive that change at reasonable cost is an economy-wide fee levied on the carbon content of climate-polluting fossil fuels. At least since the days of Adam Smith, economists have understood the power of the price system to allocate resources and steer supply and demand. That’s why an unprecedented number of economists—more than 3,600, including 28 Nobel laureates, 15 former chairs of the Council of Economic Advisers, and four former chairs of the Federal Reserve—agree that “a carbon tax offers the most cost-effective lever to reduce carbon emissions at the scale and speed that is necessary.”28 The IPCC, among many other institutions, agrees. Its Sixth Assessment Working Group II Report, released earlier this year, declares, “Pricing of greenhouse gasses, including carbon, is a crucial tool in any cost-effective climate change mitigation strategy, as it provides a mechanism for linking climate action to economic development.”(29) Such pricing initiatives already exist in 45 countries, as well as several U.S. states. Major adopters of carbon pricing include the European Union, Great Britain, and Canada.(30)

This short testimony cannot do justice to the vast literature supporting this consensus support for carbon pricing.(31) Instead, let us make a few brief points:

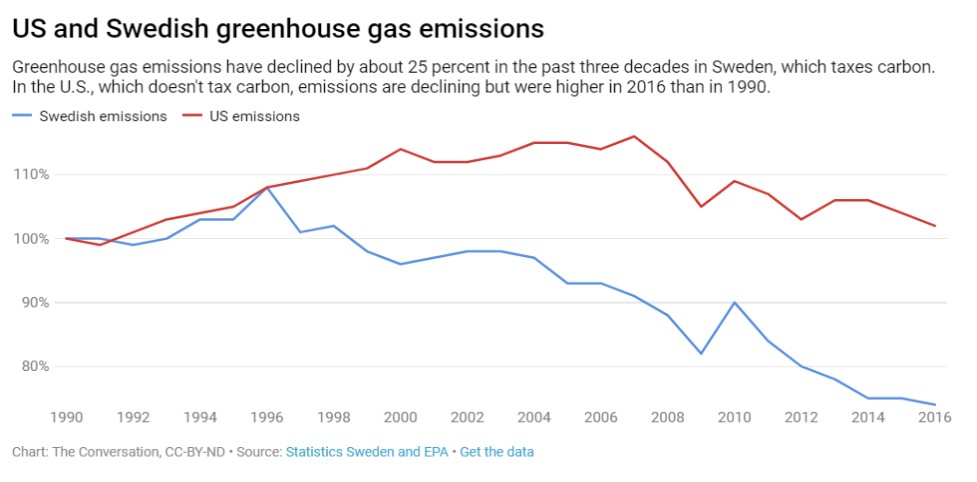

- Carbon pricing has proven effective. Norway and Sweden, early adopters of carbon taxes, used them to cut average annual carbon dioxide emissions by about 18 percent per year, or three metric tons per capita annually, over the 14 years following 1990.(32) A modest carbon tax imposed by Great Britain on the power sector in 2013 slashed emissions in that industry by a remarkable 55 percent in just five years.(33) A recent study of the EU found that increases in its carbon price of just $10 per ton of carbon dioxide cut long-run per capita emissions by 4.6 percent.(34)

- Carbon taxes may be the only standalone policy that can plausibly achieve President Biden’s ambitious goal of slashing U.S. greenhouse gas emissions 50 percent by 2030 (from a 2005 baseline). Modeling by Resources for the Future identifies several carbon fee bills pending in Congress that could meet this test. More modest carbon fees could also supplement other proposed climate policies to approach this goal.(35)

- Carbon taxes spur innovation. Of great relevance to the topic of this hearing, the overwhelming consensus of economists also supports the premise that a “consistently rising carbon price” will “encourage technological innovation” to lower the cost of transitioning to a low-carbon world. Glenn Hubbard, former chairman of the Council of Economic Advisors under President George W. Bush, observed, “business people don’t innovate because it feels good; they innovate because there’s a return to that innovation. If you want a return to that innovation . . . you will need to put a price on carbon.”(36) A survey of 35 large U.S. companies found that “among the nine policy tools listed in the survey, putting a price on carbon was by far the most important action that respondents think the U.S. government could take to advance low-carbon innovation.”(37) A 2021 report by the National Academies of Sciences endorsed an economy-wide price on carbon to “unlock innovation in every corner of the economy and . . . encourage a cost effective route to net zero.”(38)

- Carbon taxes offer many co-benefits. Greatest of all are the health benefits of reducing deadly particulates and toxic air emissions released by the burning of fossil fuels. A paper published last year in the Proceedings of the National Academy of Sciences estimated that Americans would value the longer lives associated with cleaner air resulting from a climate policy aimed at limiting warming to 2oC at roughly $700 billion per year over the next two decades.39 In addition, carbon pricing has had slightly positive effects on GDP and employment growth in the EU, without fueling inflation. One scholarly study predicts that a U.S. carbon tax aimed at reducing emissions by 35 percent would modestly boost labor income, consumption, output, and labor force participation, while stimulating adoption of green technology and clean energy jobs.(40) A national carbon fee will also help U.S. businesses compete internationally as the EU and other jurisdictions with carbon pricing move forward with plans to impose border carbon adjustments.(41)

- Carbon taxes raise revenue. Unlike other climate policies, carbon fees offer great flexibility by generating revenue that can be returned to individuals and used to meet other public needs identified by legislators. As the IPCC noted in a recent report, “using tax revenues to issue payments back to taxpayers that are disproportionately impacted or to redistribute capital among regions may be one of the most important features of carbon tax policies.”(42)

- Carbon taxation is politically viable. Consistent with much other polling, recent surveys by the Yale Program on Climate Communications find that 66 percent of registered U.S. voters support requiring fossil fuel companies to pay a carbon tax.(43) The policy even has support from some big oil companies such as BP, which calls it “fair, efficient, and effective.”(44)

Conclusion

Putting a rising price on carbon is the most effective policy to address both domestic energy security and the global climate crisis. Many additional policies, including strong federal support for R&D and possibly transitional support for new industries and affected communities, will be needed to fully decarbonize our economy by 2050. In the meantime, however, every step we take toward reducing America’s dependence on volatile fossil fuel markets, avoiding further stranded investments, and making efficient use of domestically produced renewable and other clean energy, will enhance our energy security and give us more time to adapt to the many challenges we already face from climate change. Citizens’ Climate Lobby looks forward to working with this Committee and others in Congress to help make such solutions possible.

(1) See https://tradingeconomics.com/commodity/ and “Gas Prices Shoot Up at Fastest Rate on Record,” Wall Street Journal, March 22, 2022.

(2) “U.S. Oil Industry Uses Ukraine Invasion to Push for More Drilling at Home,” New York Times, February 26, 2022.

(3) “As Fuel Prices Rise to Record Highs, Governments Look for Solutions,” Reuters, March 10, 2022.

(4) “Fact Checking Biden’s claim that there are 9,000 unused oil drilling permits,” Politifact.com, March 9, 2022, https://www.politifact.com/factchecks/2022/mar/09/joe-biden/fact-checking-bidens-claim-there-are-9000-unused-o/. The Dallas Fed reports that more than 80 percent of oil executives surveyed blame investor pressure, personnel shortages, supply-chain issues, or lack of access to financing for constraints on their growth. Only six percent cite “government regulations.” Dallas Fed Energy Survey, First Quarter, March 23, 2022, https://www.dallasfed.org/research/surveys/des/2022/2201.aspx.

(5) International Energy Agency, “A 10-Point Plan to Cut Oil Use,” March 2022, https://www.iea.org/reports/a-10-point-plan-to-cut-oil-use.

(6) University of California energy economist Severin Borenstein comments that “focusing on the price of gasoline obscures the larger social issue. The problem is rising income and wealth inequality, which makes everything harder to afford, including housing, food, and, yes, gasoline. Unlike housing, however, . . . gasoline prices haven’t actually risen much in real terms over the last 17 years. What we need to address is the everything affordability crisis for people being left behind, with stronger social programs, educational options, and job opportunities.” Severin Borenstein, “Is Gasoline Becoming Unaffordable?” Energy Institute Blog, UC Berkeley, November 29, 2021, https://energyathaas.wordpress.com/2021/11/29/is-gasoline-becoming-unaffordable/.

(7) European Commission, “REPowerEU,” March 8, 2022, https://eur-lex.europa.eu/legal-content/EN/TXT/HTML/?uri=CELEX:52022DC0108.

(8) Gasoline chart from Trading Economics https://tradingeconomics.com; Solar PPA price chart from Lawrence Berkeley Laboratory, “Tracking the Sun,” 2021, https://emp.lbl.gov/sites/default/file/utility_scale_solar_2021_edition_slides.pdf.

(9) IPCC, Working Group II, Climate Change 2022: Impacts, Adaptation and Vulnerability (United Nations, 2022), https://www.ipcc.ch/report/sixth-assessment-report-working-group-ii/

10 Lisa Friedman, “U.N. Chief Warns of ‘Catastrophe’ With Continued Use of Fossil Fuels,” New York Times, March 21, 2022; D. Calverley and K. Anderson, Phaseout Pathways for Fossil Fuel Production Within Paris-compliant Carbon Budgets (Tyndall Centre for Climate Change Research, March 2022), https://www.research.manchester.ac.uk/portal/en/ publications/phaseout-pathways-for-fossil-fuel-production-within-pariscompliant-carbon-budgets(c7235a8e-e3b1-4f44-99de-c27958c03758).html. For a bleak assessment of how the U.S. and other nations are doing, see Climate Action Tracker, “Glasgow’s 2030 Credibility Gap,” November 9, 2021, https://climateactiontracker.org/publications/glasgows-2030-credibility-gap-net-zeros-lip-service-to-climate-action/.

11 “‘This is a fossil fuel war’: Ukraine’s top climate scientist speaks out,” Guardian, March 9, 2022.

12 National Intelligence Council, National Intelligence Estimate NIC-NIE-2021-10030-A, “Climate Change and International Responses Increasing Challenges to US National Security Through 2040,” https://www.dni.gov/files/ODNI/documents/assessments/NIE_Climate_Change_and_National_Security.pdf.

13 U.S. Global Change Research Program, The Fourth National Climate Assessment, Volume II: Impacts, Risks, and Adaptation in the United States, 2018, https://nca2018.globalchange.gov/chapter/4/. Other relevant reports from official agencies include The World Bank, Climate Impacts on Energy Systems: Key issues for energy sector adaptation (2011) https://www.esmap.org/sites/esmap.org/files/Executive summary_0.pdf; U.S. Environmental Protection Agency, “Climate Impacts on Energy,” 2017, https://19january2017snapshot.epa.gov/climate-impacts/climate-impacts-energy_.html; and Amy Myers Jaffe, et al., Impact of Climate Risk on the Energy System (New York: Council on Foreign Relations, September 2019).

14 Neil Chatterjee and Greg Bertelsen, “Achieving Grid Reliability and Decarbonization through Carbon Pricing,” Climate Leadership Council, March 2022, https://clcouncil.org/report/achieving-grid-reliability/.

15 Congressional Research Service, “Oil and Gas Disruption from Hurricanes Katrina and Rita,” April 6, 2006.

16 Black and Veatch, “Hurricanes Harvey and Irma: Impacts to U.S. Oil and Gas Sector,” November 15, 2017, https://www.3blmedia.com/news/hurricanes-harvey-and-irma-impacts-us-oil-and-gas-sector.

17 On hurricane attribution, see, for example, Geert Jan van Oldenborgh, et al., “Attribution of extreme rainfall from Hurricane Harvey, Environmental Research Letters, 12 (2017), https://iopscience.iop.org/article/10.1088/1748-9326/aa9ef2; Kieren Bhatia, et al., “Projected Response of Tropical Cyclone Intensity and Intensification in a Global Climate Model,” Journal of Climate, 31 (October 2018), https://doi.org/10.1175/JCLI-D-17-0898.1; and IPCC Working Group I, AR5 Climate Change 2021: The Physical Science Basis, “Weather and climate extreme events in a changing climate,” https://www.ipcc.ch/report/ar6/wg1/downloads/report/IPCC_AR6_WGI_Chapter_11.pdf. On Ida, see U.S. Energy Information Administration, “Hurricane Ida disrupted crude oil production and refining activity,” September16, 2021, https://www.eia.gov/todayinenergy/detail.php?id=49576; “Oil and Gasoline Futures Gyrate After Ida Disrupts Production,” New York Times, August 30, 2021; “Far-Reaching Hurricane Ida Effects Linger for Oil and Gas,” Upstream, September 1, 2021, www.upstreamonline.com/production/far-reaching-hurricane-ida-effects-linger-for-oil-and-gas/2-1-1060345.

18 Ben Strauss and Remik Ziemlinski, “Sea Level Rise Threats to Energy Infrastructure,” Climate Central, April 19, 2012, http://slr.s3.amazonaws.com/SLR-Threats-to-Energy-Infrastructure.pdf.

19 Cleo Paskal, “The Security Implications of Climate Change in the OSCE Region,” OSCE report PC.NGO/10/09, October 12, 2009, https://www.osce.org/files/f/documents/0/4/39785.pdf.

20 “PG&E Aims to Curb Wildfire Risk by Burying Many Power Lines,” New York Times, July 21, 2021.

21 Jordan Macknick, et al., “Water and Climate Impacts on Power System Operations: The Importance of Cooling Systems and Demand Response Measures,” NREL/TP-6A20-66714, December 2016, https://www.nrel.gov/docs/fy17osti/66714.pdf; see also James McCall, et al., “Water-Related Power Plant Curtailments: An Overview of Incidents and Contributing Factors,” NREL/TP-6A20-67084, December 2016, https://www.nrel.gov/docs/fy17osti/67084.pdf.

22 University of Texas Energy Institute, “The Timeline and Events of the February 2021 Texas Electric Grid Blackouts,” 2021, https://energy.utexas.edu/ercot-blackout-2021.

23 Judah Cohen, et al., “Linking Arctic variability and change with extreme winter weather in the United States,” Science, 373 (September 1, 2021), https://www.science.org/doi/10.1126/science.abi9167.

24 “No, Wind Farms Aren’t the Main Cause of the Texas Blackouts,” New York Times, February 17, 2021; “Gov. Greg Abbott wants power companies to “winterize.” Texas’ track record won’t make that easy,” Texas Tribune, February 20, 2021; Joshua W. Busby, et al., “Cascading risks: Understanding the 2021 winter blackout in Texas,” Energy Research & Social Science, 77, (July 2021), https://www.sciencedirect.com/science/article/pii/S2214629621001997.

25 Peter Erickson, et al., “Carbon lock-in from fossil fuel supply infrastructure,” Stockholm Environment Institute, 2015, https://www.jstor.org/stable/resrep02768; FSOC, Report on Climate-Related Financial Risk, 2021, https://home.treasury.gov/system/files/261/FSOC-Climate-Report.pdf.

26 IEA, Net Zero by 2050: A Roadmap for the Global Energy Sector, May 2021, https://iea.blob.core.windows.net/assets/7ebafc81-74ed-412b-9c60-5cc32c8396e4/NetZeroby2050-ARoadmapfortheGlobalEnergySector-SummaryforPolicyMakers_CORR.pdf. See also the findings of a group of Princeton researchers on “Net-Zero America: Potential Pathways, Infrastructure, and Impacts,” December 2020, https://netzeroamerica.princeton.edu.

27 “Americans Largely Favor U.S. Taking Steps To Become Carbon Neutral by 2050,” Pew Research Center, March 1, 2022, https://www.pewresearch.org/science/2022/03/01/americans-largely-favor-u-s-taking-steps-to-become-carbon-neutral-by-2050/.

28 “Economists’ Statement on Carbon Dividends,” https://clcouncil.org/economists-statement/.

29 IPCC report, op. cit., chapter 18.

30 World Bank, “Carbon Pricing Dashboard,” https://carbonpricingdashboard.worldbank.org/.

31 A good one-stop source is Gilbert Metcalf, Paying for Pollution: Why a Carbon Tax is Good for America (New York: Oxford University Press, 2019).

32 S. F. Sachintha, “The Environmental Effectiveness of Carbon Taxes: A Comparative Case Study of the Nordic Experience,” in World Bank (ed.), First International Conference on Carbon Pricing. World Bank Working Paper Series, November 2019, p. 323, https://documents1.worldbank.org/curated/en/121521574783671207/pdf/The-First-International-Research-Conference-on-Carbon-Pricing.pdf.

33 Klaus Gugler, et al., “Effectiveness of climate policies: Carbon pricing vs. subsidizing renewables,” Journal of Environmental Economics and Management, 106 (March 2021).

34 Emanuel Kohlscheen, et al., “Effects of Carbon Pricing and Other Climate Policies on CO2 Emissions,” CESifo Working Paper 9347, October 2021, https://www.cesifo.org/DocDL/cesifo1_wp9347.pdf.

35 Resources for the Future, “Carbon Pricing Calculator,” https://www.rff.org/publications/data-tools/carbon-pricing-calculator/; Rhodium Group, “Expanding the Reach of a Carbon Tax: Emissions Impacts of Pricing Combined with Additional Climate Actions,” October 2020, https://rhg.com/research/expanding-the-reach-of-a-carbon-tax/; Marc Hafstead, et al., “Emissions Projections under Alternative Climate Policy Proposals,” RFF Issue Brief, September 16, 2021, www.rff.org/publications/issue-briefs/emissions-projections-under-alternative-climate-policy-proposals/.

36 “Hubbard Argues for a Carbon Tax,” Wall Street Journal Environmental Capital blog, June 28, 2007.

37 Pew Center on Global Climate Change, “A Survey of Company Perspectives on Low Carbon Business Innovation 3,” 2011, https://www.nap.edu/download/25932.

38 National Academies of Sciences, Engineering and Medicine, Accelerating Decarbonization of the U.S. Energy System, 2021, https://www.nap.edu/download/25932.

39 Drew Shindell, et al., “Temporal and spatial distribution of health, labor, and crop benefits of climate change mitigation in the United States,” PNAS, November 1, 2021, https://www.pnas.org/doi/10.1073/pnas.2104061118; “Clean energy could save American lives to tune of $700 billion per year,” Yale Climate Connections, November 1, 2021, https://yaleclimateconnections.org/2021/11/clean-energy-could-save-american-lives-to-tune-of-700-billion-per-year/

40 Gilbert Metcalf and James Stock, “Measuring the Macroeconomic Impact of Carbon Taxes,” American Economic Review Papers and Proceedings (2020), https://works.bepress.com/gilbert_metcalf/121/; Maximilian Konradt and Beatrice Weder di Mauro, “Carbon Taxation and Inflation: Evidence from the European and Canadian Experience,” Centre for Economic Policy Research, Discussion Paper DP16396, 25 July 2021, CEPR-DP16396_free_download.pdf; Alan Shapiro and Gilbert Metcalf, “The Macroeconomic Effects of a Carbon Tax to Meet the US Paris Agreement Target,” RFF Working Paper 21-14, May 2021, https://media.rff.org/documents/WP_21-14_Metcalf.pdf.

41 European Council, “Council agrees on the Carbon Border Adjustment Mechanism,” March 15, 2022.

42 IPCC report, op. cit., chapter 18.

43 Yale Program on Climate Change Communications, “Yale Climate Opinion Maps 2021,” https://climatecommunication.yale.edu/visualizations-data/ycom-us/.

44 BP, “Carbon Pricing,” https://www.bp.com/en_us/united-states/home/who-we-are/advocating-for-net-zero-in-the-us/carbon-pricing.html.